We believe we have the resources to rewrite the story of gentrification in Ward 2. Together, we can own and manage real estate that builds equity for tenants, resists rent inflation, and preserves our community for generations to come.

Property value in Ward 2 is sky-high

$350,000 for a 600 sq ft apartment, or $1 million for a rundown row home. Crunch the numbers—$30,000 down and $2,200 a month for an apartment, $100,000 down and $6,700 a month for a row home, on the hook for 30 years, playing almost twice as much in interest than the value of the home alone.

For most of us, already paying half our paycheck to landlords, these numbers are a pipe dream.

But it doesn’t have to be this way. We can take control of our lives in a tangible way: by collectively owning the land we live on. We’re proposing a bold solution: a collectively owned, nonprofit housing model that puts power back in our hands. Tenant-owners and community members will govern the cooperative, ensuring stable, affordable housing that keeps our neighbors rooted and resilient.

We believe we have the resources to rewrite this story. Together, we can own and manage real estate that builds equity for tenants, resists rent inflation, and preserves our community for generations to come.

At just $9,000 per month, a few tenants and community groups can own and govern a cooperative, and seed a network of housing outside of the pressures of housing markets.

Who lives in Ward 2?

Here are some observations:

Why is this needed in Ward 2? While the median household income is relatively high there is a huge income gap in our community—around 20% make under $50,000 a year, and a significant portion live under the poverty level.

A big majority of our neighbors are renters facing increasing rents. Many are currently shut out of control of their living situations, especially with the high cost of property in Ward 2.

People can’t afford to stay: every year, 30% move out of the neighborhood—more than double the amount of the US generally and 1.5 times the rate of the District.

62% in this neighborhood live alone. Many residents don’t have children and are single, looking for a community and a space to be a part of.

Really affordable cooperatively controlled, owned, and operated network of housing

Here’s what we’re proposing

A member-run not-for-profit that holds real estate in trust. Starting with a row-home, we’ll make cheap housing available to community members while using the English basement as a community space.

Raccoon Housing will be made up of three member groups.

Tenant Owners are residents who live on property owned by the cooperative

Grassroots Community Organization Tenants are groups that do grassroots work in the community and need physical space to do their work.

Community Members are members of our community who pay an annual membership fee to support the community.

As Raccoon Housing grows, we’ll add more and more properties, challenging the logic of the real estate market.

$253,000??

Yeah, it’s a huge number, but we’ve got some things planned that will get us to the down payment.

Annual Membership Fees: Community members who support the cooperative and want to have a voice in its governance can pay an annual membership fee. This will be a sliding scale to make sure it’s accessible to everyone. These funds would help support the cooperative’s operations and community-building efforts.

We aim to recruit 200 community members to start our initial fund. With an average annual membership fee of $100. This will raise $20,000.

Donations from Supporters: Members of the community who may not live in the cooperative but want to support it financially can make one-time or recurring donations. This can be a consistent revenue stream if the cooperative becomes an established presence in the community.

Donations from Community Groups: Groups that are actively involved in our community can make donations and grants to this project.

We aim to raise $70,000 from community members and groups to go towards paying the down payment. We’re talking to a number of groups already to support us in this work.

Community forgivable loans: Members of the community who may not live in the cooperative but want to support it financially can make a low interest forgivable loan to the land trust.

We aim to ask our community to make loans directly to us at a favorable and forgivable rate for $80,000

Traditional loans and grants: with a strong business plan and strong community support, we’ll be able to get favorable loans and grants to cover the remaining gap: $83,000.

What if we get that?

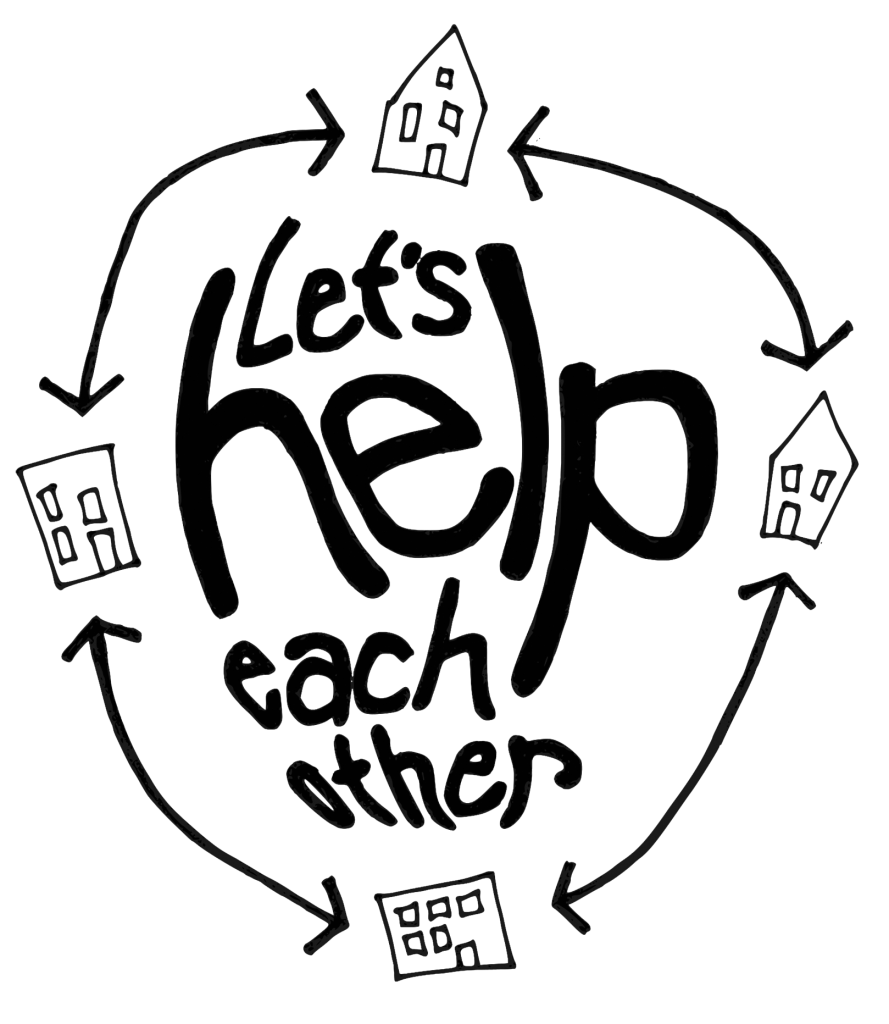

The primary cost for us is to purchase a property. While we have costs associated with property management, governance, real estate transactions, etc. we aim to have a lot of this work covered by community organization members (e.g. through relationships with Ward 2 Mutual Aid, the DC Tool Library, etc).

But, once we have the building we’ll have recurring costs. With $100,000 down, our mortgage will be roughly $7,000 each month. Alongside annual membership fees and continued work on donations, we plan on covering this with a couple of income streams:

Tenant-Owner Contributions: One of the primary sources of revenue will be the monthly residency payments from tenant-owners. These payments will be lower than typical market rents but still generate enough to cover operational costs, maintenance, and reserves for future property investments.

Rent will be charged an average of 25% of the tenant-owner’s income. We will aim to have three tenants who make an average of $50,000 a year. This will raise $1,000 a month, or $12,000 a year, per tenant.

Tiered Rent for Community Organizations: Offering affordable rent to grassroots community organizations that rent space in cooperative-owned properties will also bring in revenue. These rents can be adjusted based on the organization’s ability to pay but still cover operating expenses.

A Community Organization could be—for example—a local food co-operative, which would pay $1,000 a month, or $12,000 a year.

| Total Monthly | $9,000 |

|---|---|

| Tenants | $3,000 |

| Community tenants | $1,000 |

| Membership fees | $3,000 |

| Additional donations | $2,000 |

And then what?

Buying a single home is just step one of a long plan. We’re looking to models like Rhizome, the Douglas Community Land Trust, Baldwin House, and the Ella Jo Baker Intentional Community to think about what it looks like to have our initial purchase act as a seed for future growth and bringing more spaces into collective ownership and management.

I’m in! How can I help?

We’re rooted in ownership, community, solidarity, and resilience. We are creating permanently affordable, collectively owned housing in Ward 2.

- We’re looking for advice and connections to groups interested in supporting this work.

- By joining or donating, you’re helping to combat displacement and gentrification.

- Membership gives you a voice in the cooperative and supports a more equitable Ward 2.

Together we will build the kind of neighborhood that doesn’t displace people because they can’t afford to live here, the kind we want to live in.